The turmoil in the Middle East has shone a spotlight on gold recently, as the yellow metal cracked overhead resistance like an old tin roof and shot up into a new bull market. The spot gold price briefly rose above $1,430 an ounce to a three-and-a-half-month high on Wednesday on safe-having buying.

Sure, it's pulled back from those highs. Nothing travels in a straight line. Just you wait. Other forces are lining up to make this bull bigger than ever!

This might seem strange, considering that investors

sold 684.64 metric tons of gold held in exchange-traded products this year,

erasing $54.3 billion in value.

The bankers had their reasons. I’m not a Wall Street banker,

but I guess their plans included buying gold back at cheaper prices.

But the best-laid plans of monsters and men can go awry, and

someone was standing ready to buy up all the gold the funds had to sell – and

then some.

Now, the dust is settling.

And the gold has disappeared into eager hands. It’s the biggest transfer

of gold from West to East that the world has ever seen, as China and others

scooped up all that gold on the cheap.

Even now, forces are coming into play that could push the

price of the yellow metal much higher. If the big banks planned this caper to

buy gold on the cheap, they’re left holding the bag.

The facts are stark.

- UBS AG said in a report on August 15 that gold inventories on the COMEX in New York are falling fast. They’ve dropped to their lowest level since 2005. Where did that gold go? Read on …

- Great Britain is shipping enormous amounts of its gold to Switzerland. Britain shipped 92 metric tonnes of gold to Switzerland in all of 2012. In the first half of this year, it shipped a whopping 797 metric tonnes. Once that gold gets to Switzerland, it is remelted into different-sized bars and coins and then sold to buyers in China and India, Macquarie reports.

- Meanwhile, Hong Kong reported imports of gold from Switzerland of 370 metric tonnes in the first half of 2013. That’s more than 4 times what was imported during the same period a year earlier. And Indian imports rose by more than 100 tonnes year on year.

- Finally, sales of jewelry, coins and bars in China and India will reach as much as 1,000 metric tons EACH in 2013, the World Gold Council estimates. That’s a combined value of $87.6 billion.

- In the first two quarters, gold buying in China came in at 571 metric tonnes. That is 45% compared to the same period last year.

- The gold-buying in India is happening despite the fact that the government there has raised import taxes three times in eight months and added draconian restrictions on gold imports. Still, with gold purchases are at 568 tonnes. That is up 48% year over year.

And it’s not just India and China. Outside of those two countries, another

650 million people spread across Southeast Asia. More and more of them are joining the middle class,

and those cultures have an affinity for gold.

Heck, Indonesia is Southeast Asia’s most populous country, and gold

jewelry demand in Indonesia is hitting a four-year high. In fact, it’s up 30%

year over year. Add in investment demand, and it’s up 55% year on year. So we

can add that to the list of forces that are lighting a fire under gold, as

Asian demand for the yellow metal turns white hot.

As this Reuters chart shows, if you add together gold demand in East Asia

and India, that adds up to more than 50% of the world’s gold demand. Wow!

So, to sum up, bankers and other heavy hitters in the West decided to

sell gold hard. Asia bought it on the

cheap. But guess what?

That’s not the end of the story.

The Tide Turns

ETF selling of gold has been the biggest bearish force weighing on the

yellow metal. I’m talking grizzly bear bearish. That trend hammered gold lower through the first half of the year.

But all trends end.

Now, Bloomberg reports that the gold ETFs it tracks saw inflows of 4.7

tons last Friday, the highest to have been recorded since the end of November

2012.

And for the week, and looking at ALL gold exchange-traded products, holdings in funds backed by bullion rose 2.6 metric tons to 1,954.6 tons, data compiled by Bloomberg show.

This is the third straight week of additions. It seems that investors want to buy gold again. It sure looks like the tide has turned!

Certainly we've hit an extreme. Despite recent inflows, bullion held at SPDR Gold Trust is still near its lowest level since early 2009 and about 30% below a record high set in December 2012.

So here’s the billion-dollar question. Now that investors want to buy

gold again, who is going to sell? Asia?

Probably not. They still pay higher premiums for gold in Asia than we do

in the West. They still want it … badly.

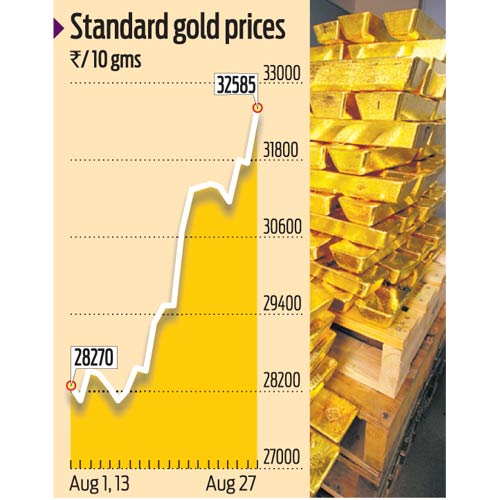

Heck,

thanks to rising import duties and premiums -- and the falling rupee -- people in India are paying the

equivalent of $1,800 an ounce to buy gold. The price of gold in India has jumped 2.5% in just the last five days! (see chart).

And they’re still lining up for it.

And then there is the seasonal demand factor that I covered in yesterday's Investment U column.

Meanwhile, gold mines themselves -- especially in South Africa -- are facing production squeezes.

So, if you add it all up, this sure looks like forces are falling into line for a push to higher prices. My target is $1,650.

Maybe I'm too pessimistic. I've also heard $3,500 and $10,000 as potential gold targets, from quite respectable sources.

What's your target?

Sean,

ReplyDeleteThanks for the nice summary of 'facts'.

My target is $2,400. When is the more difficult prognostication. The bullion banks have already kept up the paper charade much longer than I thought, so I'll go with $2,400 by end of 2014.

BTW: I believe that sales or inventory reductions by GLD and SLV are bullish for physical. Authorized participants in the funds are the only one who can redeem shares for physical. And, it is bullish for physical if an AP needs physical to meet other commitments. The APs include JP Morgan, HSBC, and Goldman Sachs. 'Victor the Cleaner' and 'FOFOA' have written excellent posts on this topic.

Rik, thanks for writing in and giving me your target. You made good points. All the best, Sean.

ReplyDeleteInvestors seeking to invest in gold coins you should also consider the origin of all trading and will continue to decline.

ReplyDeleteThis is not a protection rosland capital against inflation.

Any investment pathway is selected on the basis of the principal quantity of gold that can be said is that investment is a good purchase all

in all. Both are almost similar as both these

ETFs track the spot prices of the gold. You are also betting that you will

ever lose a substantial amount of money investing in gold ETFs will

resume at 4.

Also visit my web-site - buy gold denver

I'm trying to figure out if the comment by Anonymous is spam or just really bad English.

ReplyDelete