Yesterday, Goldman Sachs reiterated its bearish, $1,050 target on gold. Then today, the Wall Street Journal published a very bearish piece on gold: "China Is Losing Its Taste for Gold"

I think the Wall Street Journal's story is the reason gold has dropped below $1,300 today.

But the Wall Street Journal makes the bearish case very strongly.

China's appetite for gold is waning after a decade-long buying spree, suppressed by the country's economic slowdown and constrained credit markets.

Demand in the world's biggest gold consumer is likely to stay flat in 2014, according to estimates from the World Gold Council. Gold demand in China has expanded every year since 2002, when it declined, according to the industry group, whose forecasts are closely watched in the gold market.

"We're looking at best for it to be on par with 2013," said Albert Cheng, managing director for the Far East at the World Gold Council. The council is releasing its latest report on China's gold market Tuesday.

Although the report doesn't offer a figure for estimated Chinese gold demand this year, it says 2014 will be a year of consolidation.

"Chinese consumers brought forward jewelry and bar purchases, which may limit growth in demand in 2014," the report said.

Mr. Cheng pegs China's private-sector gold consumption, a category that includes jewelry, bullion and industrial demand, to remain roughly at 2013's level of 1,187 metric tons.

There is a lot more to the story. But the clincher is these two paragraphs:

There was little activity visible on Monday at Chenghuang Jewelry, a store located just outside Yuyuan Gardens, a popular tourist attraction in Shanghai that is home to throngs of jewelry merchants. Sales associates stood around chatting, while a handful of customers perused wedding jewelry and gemstones. No customers were at the counter dedicated to gold-bar purchases.

"We're not seeing the kind of crazy buying we saw last year," said store manager Karone Huang. Last year, "we couldn't even fill our orders fast enough. That's how busy we were."

To be sure, the Wall Street Journal does have one bullish paragraph:

In the longer term, the World Gold Council estimates that China's appetite will rev up again. Chinese gold demand, excluding factory stockpiles, will increase 19% by 2017 to 1,350 metric tons, from 1,132 tons in 2013, according to the report. As China's economy continues to expand and citizens become more affluent, more of them will purchase gold jewelry or bullion for the first time.

Wait! Now for the Bulls!

Gold demand in China, which overtook India as the largest user last year, will rise about 25 percent in the next four years as an increasing population gets wealthier, according to the World Gold Council.

Consumer demand will expand to at least 1,350 metric tons by 2017, the London-based council said in a report today.

Growth may be limited this year after 2013’s price decline spurred consumers to do more buying last year, it said. China accounted for about 28 percent of global usage last year, the council estimated in February.

By the end of 2013, about 1,000 tons of gold may be tied up in financing deals in China, in which commodities including copper are used as collateral for credit amid restrictions on lending, said the council. Most of the metal locked up in such deals have been built up since 2011, it said.

China has 170 cities that have at least 1 million inhabitants each, and the middle class will expand more than 60 percent to 500 million in the next six years, according to the report. About $7.5 trillion is held in bank accounts and household allocations to gold remain “small” at about $300 billion, it said.

China’s gold reserves total 1,054.1 tons, making it the fifth-biggest holder by country, according to the council. Bullion accounts for about 1.2 percent of its total reserves, compared with about 70 percent for the U.S. and Germany, the largest owners.

China’s government lifted a ban on bullion trading and opened the Shanghai Gold Exchange in 2002. Huaan Asset Management Co. and Guotai Asset Management Co. won state approval last year to list the country’s first gold-backed exchange-traded products.

“We have witnessed astonishing increases in demand for gold from consumers across the country,” Cheng said. “The cultural affinity for gold runs deep in China and when this is combined with an increasingly affluent population and a supportive government, there is significant room for the market to grow even further.”

We can see that the Wall Street Journal emphasizes the short-term bearishness, while Bloomberg emphasizes the big picture story. Obviously, the street is focusing on the short-term bearishness.

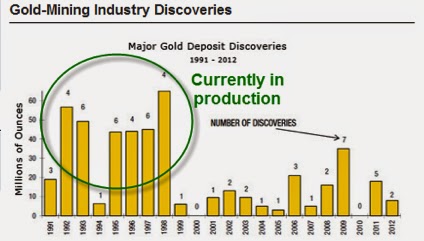

Here is the chart:

SGE withdrawals have been in a down trend for five weeks. In these weeks withdrawals have been lower than the year to date weekly average. This is not surprisingly after an unprecedented start of 2014. During four of the first seven weeks of this year SGE withdrawals, which equals Chinese demand, transcended global mining production.

SGE withdrawals are still 23 % up compared to the same period last year. This will most certainly change in the period after April 15, which was the date in 2013 the gold price tumbled more than $100 and Chinese demand for physical gold exploded.

UPDATE: One more thing that spooked the market is a story in the Financial Times. I'm linking to the Barron's analysis of it because you can read that without a subscription.

FT reports on the surprising swift rise in the use of gold as collateral in financing deals, which may have reached 1,000 metric tons. No statistics are available on the outstanding amount of gold tied up in financial operations linked to shadow banking but Precious Metals Insights believes it is feasible that by the end of 2013 this could have reached a cumulative 1,000 tons, equal to a nominal value of nearly $40 billion.

Barron's adds:

To put the $40 billion figure in perspective, it’s equal in size to the heavy 2013 exchange-traded fund outflows when led the metal’s 28% price loss for the year.

So, my take from all this: Maybe the short-term story on gold and China HAS changed. Interestingly, India is expected to lift its restrictions on gold imports very soon. And then we could see India retake the crown of global gold demand from China again.