"In the Valley of the Blind, the One-Eyed Man Is King." Market charts, analysis and links

Wednesday, August 26, 2015

Excellent Stats on China's Economy and Global Growth

China has contributed as much to world GDP growth as the US in the past decade and a half, and even more than the world’s biggest economy since the 2008 financial crisis, according to the IMF. Indeed, the IMF projects that China will generate around double what the US contributes to world output until the end of the decade. Together, the US and China are expected to generate as much world output as the rest of the world put together.

Lots of great stats in this piece. Read the rest of the story here. http://theconversation.com/how-a-chinese-slowdown-will-hit-global-growth-46655

Tuesday, August 25, 2015

Robots Panic at the Speed of Light

I was away last week, touring a potential gold project in Nevada. So, naturally, the market had to throw a hissy fit and puke up all sorts of losses. The S&P 500 dropped 5.69% last week. That’s the first 5%+ decline since September 2011.

This week started off with the Dow Jones Industrials taking a massive plunge of over 1,000 points. Then the market clawed its way back on Monday to regain nearly half of what it lost. The Dow ended down 588. Whoa! What a swing!

And now, Tuesday morning, the Dow looks poised to open up 600 points. Still, there is a real sense of panic on the Street. No one can blame investors for feeling confused. Let me show you why there is real opportunity in this market panic.

Why Is the Market Acting So Squirrely?

Earnings for S&P 500 companies are trending lower year over year. This was the initial cause for worry. Deflation led by falling commodity prices added to fears. And the general sense of dread was compounded by signs of a deeper slowdown in China.

The China government says gross domestic product grew at a 7% rate in the first half of the year. That would be the slowest growth in decades. Still, no one believes them. A Bloomberg poll of economists puts China GDP growth closer to 6.3%. Some observers say that, in reality, China’s economy may be growing as slowly as 4%.

China's manufacturing sector looks especially weak. The manufacturing sentiment index just hit its lowest level in six years. What’s more, factory orders are down and construction starts fell 16.8% over the first seven months of 2015 from a year earlier.

Why is this a huge concern? China accounts for 15% of global output. It contributes up to half of global growth. With no or much slower growth, it’s very hard to turn around those earnings I mentioned earlier.

On Monday, the Shanghai Composite tumbled by 8.5%, its biggest fall since 2007. This panicked institutions and deep-pocketed investors. And they hit the sell button.

And “button” is the operative words. A big chunk of Wall Street trading is handled by robots now. Trading algorithms are widely blamed for the “Flash Crash” that tanked stocks in May 2010. The same forces are probably in play now. Robots can panic at the speed of light. And they can change sides just as quickly, which is what we're seeing pre-market this morning.

And that’s why the Dow Jones Industrial Average dropped more than 1,000 points at the open, then spent the day zig-zagging around before closing down “only” 588 points. It’s not like the true value of the Dow 30 stocks dipped 5% at the open, then changed at the end of the day.

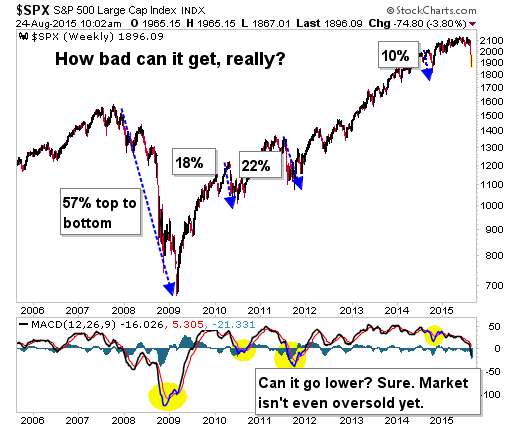

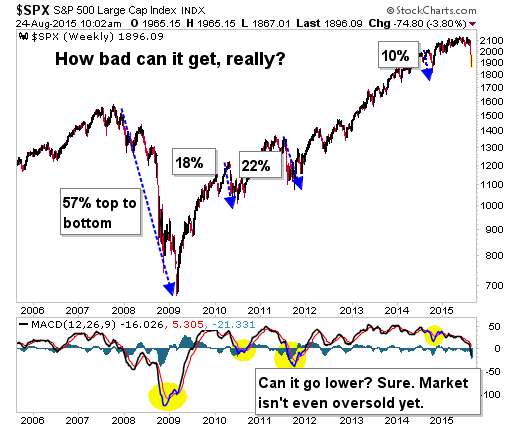

And that’s causing the crash you can see on the far right of this chart.

(Updated chart)

As this chart shows, the market goes through a lot of corrections. They’re scary, sure. Yet when you look at them in the rear view mirror, they are buying opportunities.

Let me make two more points …

What Wall Street Forgets

So, now that we know what’s going on, let’s focus on some things that robots and the deep-pocketed white-shoe crowd might have forgotten.

China Won’t Sit on Its Hands. Today's rally is sparked by the news that China is cutting its benchmark interest rate. Why this is seen as a cure-all to China's problems I can't say. But I also think that fear over China's economy is overdone.

It's true, China’s economy is slowing down. But anyone who expects China to sit by and let its economy crash without a fight is a moron. There is probably going to be another round of stimulus spending. China has a whopping $3.7 trillion in foreign-exchange reserves to help it weather shocks. And the central bank announced it plans to flood its system with new liquidity.

And something for Americans to remember is that when the Chinese get nervous, they tend to invest their money abroad. They might even stuff some of that cash under our market “mattress.”

Market Selloffs Don’t Go on Forever. Jeff Saut, chief investment strategist at Raymond James, called the bottom on Monday. In a note on Friday, he said:

Personally, I think the market just has to offer bargains that are good enough to interest investors. That’s when individuals, institutions and robots alike start buying again.

And indeed, we saw a lot of buying on Monday. Some big names opened way down and rallied back to close well above their lows. That can be the sign of a bottom.

You Can Be Proactive. And I don’t mean selling everything and going to cash. Instead, you should make shopping lists of stocks you want. And you can place stink bids to snatch up companies on the next panic. I’ll give you some ideas in just a bit.

Saut says odds are 50-50 that the market will go back and test support at lows it set Monday – and maybe a bit lower – before heading higher again. Or, it could take off.

Why would either of these things happen? In my view, because the underlying economy is strong. Retail sales jumped in July. Housing starts and sales are strong. Unemployment is down and hiring is up. And cheaper oil prices are putting more money in the pockets of many companies (outside of oil production) and consumers alike.

What would make it wrong is if the world – and the US – are sliding into recession. But I don’t see that.

Could The Doom-Meisters Be Right?

Dude, I have heard people declare “China is doomed” since 2005. Someday they’re gonna be right. But are the odds any better now than, say, during the big global recession in 2008?

No. Not unless China’s leaders have lost their will to throw money at problems. Headlines like “There’s No Saving China Now” are written by and for idiots and newbs.

What About a Deeper US Pullback?

Those calling for lower stock prices here in the U.S. could be right. Bob Doll, chief investment strategist for Nuveen Asset Management, is one of the bears. He’s a smart guy. And he's waiting before putting his money to work.

"Corrections in bull markets tend to be sharp, they tend to happen quickly but they don't turn around and go back up on a V-bottom. I just want some time to pass and seek some consolidation," he told CNBC on Monday.

There’s nothing wrong with being scared. Heck, if I hadn’t seen this kind of story play out so many times, I’d probably be scared. And if you’re too scared to invest, if your fingers are burned by recent events, I understand.

But great stocks – especially stocks that pay big, fat dividends – are trading at fire-sale prices. The worst thing that’s likely to happen if you scoop them up on sale is you’ll be paid to wait. The more likely scenario is you’ll surf twin tsunamis of both distributions and price appreciation.

So let's look at one sector ...

Energy – a Volcano of Volatility

You know I’ve saying that I think oil prices will go lower for longer. I took a lot of flak for that view. But oh, I really wish I wasn’t so darned right.

In early trade Monday morning, the price of West Texas Intermediate was down about 5.7% and traded as low as $37.75 a barrel. Like stocks, crude oil recovered some losses. But it still closed below $39. Crude oil is bouncing this morning.

Prices are as volatile as nitroglycerin. No one knows for sure what will happen. But I don’t think we’ve hit bottom in oil yet. There’s too much new supply coming online from Iran, Iraq, Saudi Arabia and more. Yes, U.S. production is falling. But many U.S. refineries are set up to process foreign grades of crude. And they’ll do just that as international supply surges.

Now for the good news. You can make money even as crude oil prices drop.

Refineries are big potential winners. My Oxford Resource Explorer subscribers already own two of the best: Alon USA Partners (NYSE: ALDW) and Phillips 66 (NYSE: PSX). These and other refineries will profit as U.S. gasoline usage climbs 6.6% year over year, supporting gasoline prices, and the input cost (crude oil) falls to the floor.

And yet refineries are being sold like their storage tanks are on fire.

Heck, just look at the chart of Valero (NYSE: VLO), a refiner I always wanted to recommend but considered more richly valued than others.

(Updated chart)

You can see Valero sold off hard on Monday – then buyers came in. Maybe it’s the cooler heads who realize lower oil prices actually boost Valero’s profits. That, and the fact that its dividend yield (2.62%) was suddenly the best it had been in nearly a year.

That doesn’t mean this stock can’t get cheaper. But like I said, you get paid to wait.

We could see other winners in energy, and not just in refining. I think companies that pay hefty dividends and can cover their distributions out of cash flow can be considered here.

If you think oil prices are near a low, you can consider buying one of the other producers as well. Thanks to the market haircut, many of them are paying dividends well in excess of their norms. And if they have the cash flow to cover it, that’s a bargain.

Some names in the big-cap producer group with hefty dividends include …

Other potential winners include …

Companies That Profit From Low Oil Prices

Winners from low oil prices include cruise lines, like Carnival Corporation (NYSE: CCL), which sports a 2.48% dividend yield, and Royal Carribbean Cruises (NYSE: RCL), which has a 1.4% dividend yield.

Airlines, trucking companies, chemical manufacturers, tire manufacturers – the list of winners from low oil prices is pretty long. So why are they being sold off now? Because that’s what a market panic is like.

As my old friend and super-smart trader Charlie Belida used to say, “when the paddy wagon comes along, it takes the good girls to jail along with the bad.”

Our job is to spot those “good girls.” They’re going higher in a hurry when the jail door opens.

Consider buying companies that have a track record of not only paying dividends but raising those dividends. In today’s bargain-bin market, there is plenty that is attractive.

Make Your Own Shopping List

This might be the bottom … or the sell-off might go deeper. In any case, you should make a list of great stocks you want to own at cheaper prices. You can decide for yourself where you wouldn’t mind owning great companies.

Here are seven of my “usual suspects” …

Just with those seven stocks, we’ve covered everything from entertainment to shopping to cybersecurity to biotech. There are a LOT of great stocks on sale. You’ll have to decide which ones are right for you.

If you’re smart, you’ll make a list of stocks you want, decide where you want to own them and put in “stink” bids. You never know what you might end up owning for pennies on the dollar, if the market’s panic cranks the dial all the way up to “11.”

One thing you shouldn’t do is worry too much about the market’s pullback. Longer-term, the market trend higher. Even if you’re only thinking about the medium term, you’ll probably still do well. It’s the short-term panics that get everyone confused … and offer opportunities for sharp-eyed investors.

The underlying fundamentals of the economy are strong. The long-term outlook for the market is very good indeed. And we are at a time when you can find “diamond” stocks in the market’s dust-bin.

Now is not the time to sit on your hands. Tough it out, put steel in your spine, and sharpen your pencil to whittle down your shopping list for what will probably be the best buying opportunity for at least the next five years.

All the best,

Sean

This week started off with the Dow Jones Industrials taking a massive plunge of over 1,000 points. Then the market clawed its way back on Monday to regain nearly half of what it lost. The Dow ended down 588. Whoa! What a swing!

And now, Tuesday morning, the Dow looks poised to open up 600 points. Still, there is a real sense of panic on the Street. No one can blame investors for feeling confused. Let me show you why there is real opportunity in this market panic.

Why Is the Market Acting So Squirrely?

Earnings for S&P 500 companies are trending lower year over year. This was the initial cause for worry. Deflation led by falling commodity prices added to fears. And the general sense of dread was compounded by signs of a deeper slowdown in China.

The China government says gross domestic product grew at a 7% rate in the first half of the year. That would be the slowest growth in decades. Still, no one believes them. A Bloomberg poll of economists puts China GDP growth closer to 6.3%. Some observers say that, in reality, China’s economy may be growing as slowly as 4%.

China's manufacturing sector looks especially weak. The manufacturing sentiment index just hit its lowest level in six years. What’s more, factory orders are down and construction starts fell 16.8% over the first seven months of 2015 from a year earlier.

Why is this a huge concern? China accounts for 15% of global output. It contributes up to half of global growth. With no or much slower growth, it’s very hard to turn around those earnings I mentioned earlier.

On Monday, the Shanghai Composite tumbled by 8.5%, its biggest fall since 2007. This panicked institutions and deep-pocketed investors. And they hit the sell button.

And “button” is the operative words. A big chunk of Wall Street trading is handled by robots now. Trading algorithms are widely blamed for the “Flash Crash” that tanked stocks in May 2010. The same forces are probably in play now. Robots can panic at the speed of light. And they can change sides just as quickly, which is what we're seeing pre-market this morning.

And that’s why the Dow Jones Industrial Average dropped more than 1,000 points at the open, then spent the day zig-zagging around before closing down “only” 588 points. It’s not like the true value of the Dow 30 stocks dipped 5% at the open, then changed at the end of the day.

And that’s causing the crash you can see on the far right of this chart.

(Updated chart)

As this chart shows, the market goes through a lot of corrections. They’re scary, sure. Yet when you look at them in the rear view mirror, they are buying opportunities.

Let me make two more points …

- Sell-offs like the ones we saw last week and yesterday are USUALLY much closer to the bottom than the top.

- The really good news is some companies we’ve always wanted to buy are going to get CHEAP!

What Wall Street Forgets

So, now that we know what’s going on, let’s focus on some things that robots and the deep-pocketed white-shoe crowd might have forgotten.

China Won’t Sit on Its Hands. Today's rally is sparked by the news that China is cutting its benchmark interest rate. Why this is seen as a cure-all to China's problems I can't say. But I also think that fear over China's economy is overdone.

It's true, China’s economy is slowing down. But anyone who expects China to sit by and let its economy crash without a fight is a moron. There is probably going to be another round of stimulus spending. China has a whopping $3.7 trillion in foreign-exchange reserves to help it weather shocks. And the central bank announced it plans to flood its system with new liquidity.

And something for Americans to remember is that when the Chinese get nervous, they tend to invest their money abroad. They might even stuff some of that cash under our market “mattress.”

Market Selloffs Don’t Go on Forever. Jeff Saut, chief investment strategist at Raymond James, called the bottom on Monday. In a note on Friday, he said:

“Recall that once the markets get into one of these selling stampedes, they tend to last 17—25 sessions, with only 1—3 sessions pauses/rally attempts, before they exhaust themselves on the downside. It just seems to be the rhythm of the thing in that it seems to take that long to get everyone bearish enough to throw in the towel and capitulate. Today would be session 24. So yes, it does feel like capitulation and participants are scared.”Saut added that after such a sell-off, it’s common for the market to finish up the next week, the next four weeks, and the next three months. He said the average return over the next 12 weeks was 5.5%.

Personally, I think the market just has to offer bargains that are good enough to interest investors. That’s when individuals, institutions and robots alike start buying again.

And indeed, we saw a lot of buying on Monday. Some big names opened way down and rallied back to close well above their lows. That can be the sign of a bottom.

You Can Be Proactive. And I don’t mean selling everything and going to cash. Instead, you should make shopping lists of stocks you want. And you can place stink bids to snatch up companies on the next panic. I’ll give you some ideas in just a bit.

Saut says odds are 50-50 that the market will go back and test support at lows it set Monday – and maybe a bit lower – before heading higher again. Or, it could take off.

Why would either of these things happen? In my view, because the underlying economy is strong. Retail sales jumped in July. Housing starts and sales are strong. Unemployment is down and hiring is up. And cheaper oil prices are putting more money in the pockets of many companies (outside of oil production) and consumers alike.

What would make it wrong is if the world – and the US – are sliding into recession. But I don’t see that.

Could The Doom-Meisters Be Right?

Dude, I have heard people declare “China is doomed” since 2005. Someday they’re gonna be right. But are the odds any better now than, say, during the big global recession in 2008?

No. Not unless China’s leaders have lost their will to throw money at problems. Headlines like “There’s No Saving China Now” are written by and for idiots and newbs.

What About a Deeper US Pullback?

Those calling for lower stock prices here in the U.S. could be right. Bob Doll, chief investment strategist for Nuveen Asset Management, is one of the bears. He’s a smart guy. And he's waiting before putting his money to work.

"Corrections in bull markets tend to be sharp, they tend to happen quickly but they don't turn around and go back up on a V-bottom. I just want some time to pass and seek some consolidation," he told CNBC on Monday.

There’s nothing wrong with being scared. Heck, if I hadn’t seen this kind of story play out so many times, I’d probably be scared. And if you’re too scared to invest, if your fingers are burned by recent events, I understand.

But great stocks – especially stocks that pay big, fat dividends – are trading at fire-sale prices. The worst thing that’s likely to happen if you scoop them up on sale is you’ll be paid to wait. The more likely scenario is you’ll surf twin tsunamis of both distributions and price appreciation.

So let's look at one sector ...

Energy – a Volcano of Volatility

You know I’ve saying that I think oil prices will go lower for longer. I took a lot of flak for that view. But oh, I really wish I wasn’t so darned right.

In early trade Monday morning, the price of West Texas Intermediate was down about 5.7% and traded as low as $37.75 a barrel. Like stocks, crude oil recovered some losses. But it still closed below $39. Crude oil is bouncing this morning.

Prices are as volatile as nitroglycerin. No one knows for sure what will happen. But I don’t think we’ve hit bottom in oil yet. There’s too much new supply coming online from Iran, Iraq, Saudi Arabia and more. Yes, U.S. production is falling. But many U.S. refineries are set up to process foreign grades of crude. And they’ll do just that as international supply surges.

Now for the good news. You can make money even as crude oil prices drop.

Refineries are big potential winners. My Oxford Resource Explorer subscribers already own two of the best: Alon USA Partners (NYSE: ALDW) and Phillips 66 (NYSE: PSX). These and other refineries will profit as U.S. gasoline usage climbs 6.6% year over year, supporting gasoline prices, and the input cost (crude oil) falls to the floor.

And yet refineries are being sold like their storage tanks are on fire.

Heck, just look at the chart of Valero (NYSE: VLO), a refiner I always wanted to recommend but considered more richly valued than others.

(Updated chart)

You can see Valero sold off hard on Monday – then buyers came in. Maybe it’s the cooler heads who realize lower oil prices actually boost Valero’s profits. That, and the fact that its dividend yield (2.62%) was suddenly the best it had been in nearly a year.

That doesn’t mean this stock can’t get cheaper. But like I said, you get paid to wait.

We could see other winners in energy, and not just in refining. I think companies that pay hefty dividends and can cover their distributions out of cash flow can be considered here.

If you think oil prices are near a low, you can consider buying one of the other producers as well. Thanks to the market haircut, many of them are paying dividends well in excess of their norms. And if they have the cash flow to cover it, that’s a bargain.

Some names in the big-cap producer group with hefty dividends include …

- BP Plc (NYSE: BP) – 7.2%

- Total SA (NYSE: TOT) – 5.8%

- Royal Dutch Shell (NYSE: RDS-B) – 6.5%. Royal Dutch Shell has another stock and symbol, RDS-A. The difference is tax treatment. Check with your accountant to see which is right for you.

Other potential winners include …

- NGL Energy Partners LP (NYSE: NGL). This oil & gas refiner and marketer sports a dividend yield over 10%.

- EnLink Midstream Partners LP (NYSE: ENLK). It connects natural gas wells to a pipeline system and markets both nat-gas and nat-gas liquids, and sports a dividend yield over 9%.

- Targa Resources Partners LP (NYSE: NGLS) runs its own network of oil and gas pipelines. Thanks to the recent pullback, it sports a dividend yield over 11%.

Companies That Profit From Low Oil Prices

Winners from low oil prices include cruise lines, like Carnival Corporation (NYSE: CCL), which sports a 2.48% dividend yield, and Royal Carribbean Cruises (NYSE: RCL), which has a 1.4% dividend yield.

Airlines, trucking companies, chemical manufacturers, tire manufacturers – the list of winners from low oil prices is pretty long. So why are they being sold off now? Because that’s what a market panic is like.

As my old friend and super-smart trader Charlie Belida used to say, “when the paddy wagon comes along, it takes the good girls to jail along with the bad.”

Our job is to spot those “good girls.” They’re going higher in a hurry when the jail door opens.

Consider buying companies that have a track record of not only paying dividends but raising those dividends. In today’s bargain-bin market, there is plenty that is attractive.

Make Your Own Shopping List

This might be the bottom … or the sell-off might go deeper. In any case, you should make a list of great stocks you want to own at cheaper prices. You can decide for yourself where you wouldn’t mind owning great companies.

Here are seven of my “usual suspects” …

- Netflix (Nasdaq: NFLX), recently 25% off its 52-week high.

- Amazon (Nasdaq: AMZN), recently 19.79% off its 52-week high.

- FireEye (Nasdaq: FEYE), recently 35% off its 52-week high.

- United Technologies (NYSE: UTX), recently 26.4% off its 52-week high. And it has a 2.75% dividend yield.

- Disney (NYSE: DIS), recently 21.4% off its 52-week high. A 1.4% dividend yield isn't big, but it's a nice extra.

- Celgene (Nasdaq: CELG), recently 19% off its 52-week high.

- Procter & Gamble (NYSE: PG), recently 24.7% off its 52-week high. And it sports a 3.69% dividend yield.

Just with those seven stocks, we’ve covered everything from entertainment to shopping to cybersecurity to biotech. There are a LOT of great stocks on sale. You’ll have to decide which ones are right for you.

If you’re smart, you’ll make a list of stocks you want, decide where you want to own them and put in “stink” bids. You never know what you might end up owning for pennies on the dollar, if the market’s panic cranks the dial all the way up to “11.”

One thing you shouldn’t do is worry too much about the market’s pullback. Longer-term, the market trend higher. Even if you’re only thinking about the medium term, you’ll probably still do well. It’s the short-term panics that get everyone confused … and offer opportunities for sharp-eyed investors.

The underlying fundamentals of the economy are strong. The long-term outlook for the market is very good indeed. And we are at a time when you can find “diamond” stocks in the market’s dust-bin.

Now is not the time to sit on your hands. Tough it out, put steel in your spine, and sharpen your pencil to whittle down your shopping list for what will probably be the best buying opportunity for at least the next five years.

All the best,

Sean

Monday, August 24, 2015

How Low can the S&P 500 ($SPX) Go?

Here is a chart showing corrections since the big one in 2008. The last correction was 10%. There was a panic at the time. Do you even remember it? It was the "Ebola Is Going to Kill America" scare.

(Updated chart)

To be sure, markets can go lower. I'm not trying to call a bottom here. But I will point out that the underlying economy in the US is quite strong. If there is a global panic, money from around the world may try to "hide" in US stocks.

Two more important points ...

1. Sell-offs like the ones we are seeing now – 800 points down indicated on the Dow – are USUALLY much closer to the bottom than the top.

2. The really good news is some companies we’ve always wanted to buy are going to get CHEAP!

Bring out Chanos to scare everyone so we can really call the bottom.

(Updated chart)

To be sure, markets can go lower. I'm not trying to call a bottom here. But I will point out that the underlying economy in the US is quite strong. If there is a global panic, money from around the world may try to "hide" in US stocks.

Two more important points ...

1. Sell-offs like the ones we are seeing now – 800 points down indicated on the Dow – are USUALLY much closer to the bottom than the top.

2. The really good news is some companies we’ve always wanted to buy are going to get CHEAP!

Bring out Chanos to scare everyone so we can really call the bottom.

Saturday, August 22, 2015

I Survived a Mining Tour and Didn't Even Get a Lousy T-Shirt

I'm in Salt Lake City, waiting for my flight back to Florida. My trip to Nevada was very productive. Also a lesson in "what can go wrong will go wrong."

Here's the craziest thing about the trip ...

Day 1: We went to look at what other companies were doing on the Carlin Trend. This involved driving up some very rough roads on a big-ass mountain. As the Nissan Armada I was riding in headed back down the mountain, we had a tire blow out. Just "whoosh!" So, we coasted to a stop on a flattish spot on the road, then we all got to take turns figuring out how to find/work the jack and the spare tire. The bolts on the wheel were hot enough to give me blisters on my fingers. But eventually, we limped back to the "Seen Better Days" Hotel & Casino, as I affectionately call it.

So that was Day 1.

On Day 2, we walked out of the hotel to find ANOTHER tire had gone flat on the Armada. So, I squeezed into the way back of the Ford Expedition, a much sturdier vehicle ... so we thought.

Then took this hell-bent-for-leather ride up the narrowest, rockiest, steepest of mountain roads. This mountain was even bigger than the mountain we went up on the first day. Our driver/host/guide announced when we passed the 9,000-foot level, and we just kept climbing as our ears popped.

Just as we finally reached the tippy-top of the mountain, the cooling system of the Expedition gave up with a shrieking hiss, as the radiator spewed steam in all directions.

So, we had lunch (we brought some AMAZING burritos from Elko) and waited for the radiator to cool down. It should have been an incredible view, but there are horrific forest fires raging to both the west and the east. So, we were smogged in.

Still, we got a better understanding for how the project we were visiting fit in to the Carlin Trend (a prolific gold belt in Nevada) and past production in the area.

One of the analysts on the trip was a car buff and he actually nursed the Expedition back to health. So we went back down the mountain. We went even faster down those narrow goat-paths this time. Yee-haw!

Finally, we got to the flatter parts of the land. But on the way out, a local hunter stopped us and pointed out that one of the front tires of the Expedition had gone flat. Yep, our third flat on the trip!

Now for the good news: The hunters, who are apparently the nicest people on Earth, changed the tire for us.

So what does this have to do with the price of gold? Not much. But it just shows how even well-planned trips can be detoured by unexpected events.

More on my trip and what I found in another post, probably next week. I have to see if the video I shot worked out. It was rather windy and my laptop was balanced precariously.

Here's the craziest thing about the trip ...

Day 1: We went to look at what other companies were doing on the Carlin Trend. This involved driving up some very rough roads on a big-ass mountain. As the Nissan Armada I was riding in headed back down the mountain, we had a tire blow out. Just "whoosh!" So, we coasted to a stop on a flattish spot on the road, then we all got to take turns figuring out how to find/work the jack and the spare tire. The bolts on the wheel were hot enough to give me blisters on my fingers. But eventually, we limped back to the "Seen Better Days" Hotel & Casino, as I affectionately call it.

So that was Day 1.

On Day 2, we walked out of the hotel to find ANOTHER tire had gone flat on the Armada. So, I squeezed into the way back of the Ford Expedition, a much sturdier vehicle ... so we thought.

Then took this hell-bent-for-leather ride up the narrowest, rockiest, steepest of mountain roads. This mountain was even bigger than the mountain we went up on the first day. Our driver/host/guide announced when we passed the 9,000-foot level, and we just kept climbing as our ears popped.

Just as we finally reached the tippy-top of the mountain, the cooling system of the Expedition gave up with a shrieking hiss, as the radiator spewed steam in all directions.

|

| Uh-oh. The radiator spews its death-gasp on a mountain-top |

|

| Our view was obscured by smoke, but still impressive |

One of the analysts on the trip was a car buff and he actually nursed the Expedition back to health. So we went back down the mountain. We went even faster down those narrow goat-paths this time. Yee-haw!

Finally, we got to the flatter parts of the land. But on the way out, a local hunter stopped us and pointed out that one of the front tires of the Expedition had gone flat. Yep, our third flat on the trip!

|

| Well, dang it! That makes three flats on one trip! |

So what does this have to do with the price of gold? Not much. But it just shows how even well-planned trips can be detoured by unexpected events.

More on my trip and what I found in another post, probably next week. I have to see if the video I shot worked out. It was rather windy and my laptop was balanced precariously.

Friday, August 21, 2015

The US Dollar ($USD) Resumes Its Downtrend

I keep watching the US dollar, because the action there defines the market. Looking at the chart, you can see that the US dollar banged its head twice on overhead resistance and has now resumed its downtrend.

(Updated chart)

Crude oil continues its March to the cellar, even as one expert/chattering head after another tries to call a bottom. Gold is headed higher as the dollar goes lower. My recommendation to $10 Trigger Alert subscribers last week that they buy Barrick Gold ($ABX) and Silver Standard Resources ($SSRI) is working out well .... for now.

Just remember things can change quickly in this market. That said, I am bullish on select precious metals miners for reasons I laid out in $10 Trigger Alert issues.

I am in Elko, Nevada, looking at a gold project. This one is very early stage, but very exciting at the same time. More on that another time.

Good luck to us all, and good trades.

(Updated chart)

Crude oil continues its March to the cellar, even as one expert/chattering head after another tries to call a bottom. Gold is headed higher as the dollar goes lower. My recommendation to $10 Trigger Alert subscribers last week that they buy Barrick Gold ($ABX) and Silver Standard Resources ($SSRI) is working out well .... for now.

Just remember things can change quickly in this market. That said, I am bullish on select precious metals miners for reasons I laid out in $10 Trigger Alert issues.

I am in Elko, Nevada, looking at a gold project. This one is very early stage, but very exciting at the same time. More on that another time.

Good luck to us all, and good trades.

Thursday, August 13, 2015

Why US Energy Boom Is Boosting the US Dollar

This was part of the material cut from my story that is running in the Non-Dollar Report's Daily Grind today ...

(Updated chart)

There are multiple forces keeping the U.S. dollar strong. One of those forces – and this next one may knock you over, so find a soft place to land before you keep reading – is a shortage of U.S. dollars.

I know, right? We have one of the most spend-thrift governments in the world, and our national debt is at nosebleed levels. But in the world of international trade, there’s a shortage of dollars … thanks to America’s energy boom.

The total U.S. dollars available to foreigners is shrinking. That’s because America used to ship vast quantities of dollars overseas to pay for oil. But U.S. crude oil production has jumped 76% since 2011. That’s a whole bunch of money we don’t have to pay Saudi Arabia, Venezuela, Nigeria and other oil-oozing international riff-raff.

And the crude we do import is at cut-rate prices. Oh, how your heart must be breaking for the squeezed oil sheiks. Here’s the thing: That money we used to send overseas sloshed around in international markets. We’ve cut our overseas oil payments by about $240 billion a year since 2011. That’s money that is no longer available globally, meaning there is a shortage of dollars.

And what happens when there’s a shortage of something? The value goes up! This makes the dollar stronger.

The stronger dollar not only tightens monetary conditions in the US. China keeps its currency in a band against the US dollar, a sort of peg. And that's one of the reasons why China has devalued its currency three times this week. Our dollar is getting too strong, and dragging China's yuan (or renminbi) along with it.

(Updated chart)

There are multiple forces keeping the U.S. dollar strong. One of those forces – and this next one may knock you over, so find a soft place to land before you keep reading – is a shortage of U.S. dollars.

I know, right? We have one of the most spend-thrift governments in the world, and our national debt is at nosebleed levels. But in the world of international trade, there’s a shortage of dollars … thanks to America’s energy boom.

The total U.S. dollars available to foreigners is shrinking. That’s because America used to ship vast quantities of dollars overseas to pay for oil. But U.S. crude oil production has jumped 76% since 2011. That’s a whole bunch of money we don’t have to pay Saudi Arabia, Venezuela, Nigeria and other oil-oozing international riff-raff.

And the crude we do import is at cut-rate prices. Oh, how your heart must be breaking for the squeezed oil sheiks. Here’s the thing: That money we used to send overseas sloshed around in international markets. We’ve cut our overseas oil payments by about $240 billion a year since 2011. That’s money that is no longer available globally, meaning there is a shortage of dollars.

And what happens when there’s a shortage of something? The value goes up! This makes the dollar stronger.

The stronger dollar not only tightens monetary conditions in the US. China keeps its currency in a band against the US dollar, a sort of peg. And that's one of the reasons why China has devalued its currency three times this week. Our dollar is getting too strong, and dragging China's yuan (or renminbi) along with it.

Monday, August 10, 2015

$Copper Chart Looks Broken

I've written a column for Energy & Resource Digest about copper. As you can see the, chart of copper looks broken.

(Updated chart)

They call this metal "Doctor Copper" because it takes the temperature of the global economy. In my article for Energy & Resource Digest, I explain why this is more of a localized flu, and not a problem infecting the world.

I'll link to the article when it goes live.

(Updated chart)

They call this metal "Doctor Copper" because it takes the temperature of the global economy. In my article for Energy & Resource Digest, I explain why this is more of a localized flu, and not a problem infecting the world.

I'll link to the article when it goes live.

Thursday, August 6, 2015

Gold, Guts and Glory

Last week, I trekked to Vancouver for the Sprott-Stansberry Natural

Resource Symposium. I would characterize the mood of both presenters and

attendees as “defiantly bullish” despite a four-year grinding bear

market. They seem to think they’ve seen the worst the market can offer;

now they’re riding it out, looking for prices to turn higher.

There were more than 500 attendees, 60 exhibitors and 25 speakers at the conference. The headliner was Robert Friedland, a longtime commodity veteran and founder of Ivanhoe Mines. In his main presentation, Friedland made the bullish case for copper. And his view on natural resources was upbeat. In his Q&A session, he said, “Either we’re very close to the bottom or it’s the end of the world. And I don’t think it’s the end of the world.”

Read the rest of this column by CLICKING HERE.

There were more than 500 attendees, 60 exhibitors and 25 speakers at the conference. The headliner was Robert Friedland, a longtime commodity veteran and founder of Ivanhoe Mines. In his main presentation, Friedland made the bullish case for copper. And his view on natural resources was upbeat. In his Q&A session, he said, “Either we’re very close to the bottom or it’s the end of the world. And I don’t think it’s the end of the world.”

Read the rest of this column by CLICKING HERE.

Wednesday, August 5, 2015

Cashing In on the Commodity Collapse

Commodity prices are going down. Boo, right? But not everybody loses. In fact, some stocks are real winners.

You can read more of my thoughts on this -- including ways to play this trend -- HERE.

You can read more of my thoughts on this -- including ways to play this trend -- HERE.

2 Ways to Play the Oil Price Squeeze

I wrote an article for Free Market Cafe on why I think oil prices are going lower, and two ways you can play it.

You can read that article by clicking HERE.

You can read that article by clicking HERE.

You Are Going to Be Hacked -- Take These 5 Steps

My Latest on Gold ... Primed for a Rebound

I wrote an article on gold which you can read by CLICKING HERE.

And here's one of five charts from that story.

And here's one of five charts from that story.

Subscribe to:

Posts (Atom)