Here are

my latest stories on the bullish case for metals AND miners.

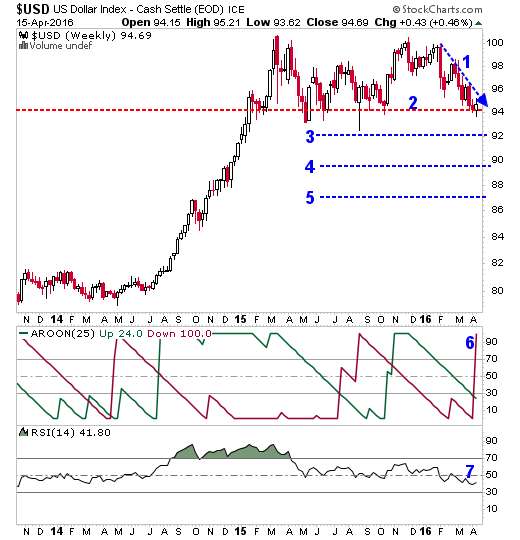

Dragons Are Barking for the U.S. Dollar … and that’s good news for

gold.

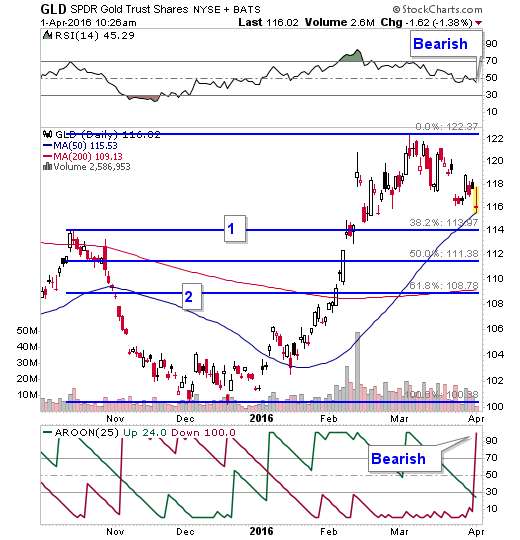

Yes, This Rally in Gold and Miners Is

for Real … Asset

Strategies International COO Rich Checkan sat down for an exclusive interview

with me. He makes some great points for a precious metals rally. I’ve

illustrated his points with two eye-popping charts.

Why Islamic Law Is About to Send Gold

Prices Soaring … the mainstream media is asleep at the switch AGAIN, missing one

of the biggest fundamental changes in the global gold markets.

China Is Hunting for Gold in Your

Backyard … in my

exclusive interview with Sprott U.S. Holdings CEO Rick Rule, he explains why

the Chinese are buying up the best miners at hefty premiums.