Source: Bloomberg

Sure, some companies in India and China seem to be getting by. You can also bet they’ve got big government sugar daddies. For the rest of the mining, world, it’s a portrait of pain.

The biggest miners are taking staggering losses. During the past 12 months, major mine owners including Freeport-McMoRan Inc. and Vedanta Resources have written down asset values by a combined $42.2 billion.

I wish I could say that was a one-time event. But it’s only 46% more than the previous year, in which miners wrote off $28.9 billion. Yeesh!

Miners are priced like their mine shafts are on fire. There are 27 precious metal miners listed on major U.S. exchanges (NYSE, Nasdaq, and NYSEMkt) that trade at less than book value. In other words, at less than what the companies would be worth if you broke them up and sold off the parts.

Does that sound like a lot? Well, hang on to your miners’ hat. We ran a scan of the major exchanges in the U.S., Canada and the United Kingdom. We looked for precious metals and industrial metals miners. We insisted on real companies, with volume, not “real estate” or shell companies. Care to guess how many trade below book value? Would you guess 50? 100? More?

The answer is 273. That’s 273 working miners, developers and explorers. All trading like investors think they should be sold for scrap.

And they’re not all small, either. Newmont Mining, the world’s largest gold miner by market cap at around $9.3 billion, trades at less than book value. Vale S.A., a $20-billion company, trades at just 0.46 times book value.

China Syndrome Hits Metals Hard

The reasons for this carnage should be obvious. Chinese demand for raw materials once seemed unquenchable. Now, mountains of overproduced and unwanted material pile up on the docks.

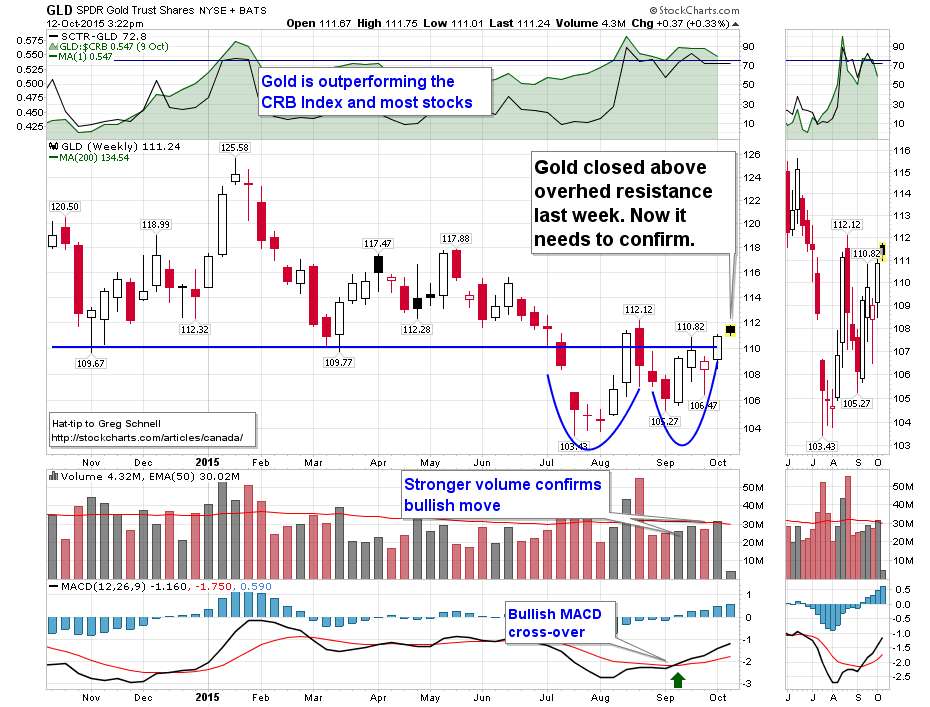

As a result, copper recently traded at a six-year low. Coal prices have fallen through the floor. The price of iron ore has fallen 75% from its recent peak. Spot gold is down 43% during the same time period.

We are seeing some producers cut back. Glencore, the world’s third-biggest copper miner, decided to suspend production for 18 months at its copper mines in the Democratic Republic of Congo and Zambia. Freeport-McMoRan (NYSE: FCX) is cutting copper output in the U.S., Mexico and Chile.

Meanwhile, zinc mines have closed in Australia and Ireland. And the supply of gold produced by mines dipped 1% in the third quarter.

And yet prices, after bouncing, turn lower again.

And some metals are seeing production increase. Iron ore producers in particular seem to be in some kind of suicide pact, blowing out the lid on production and sending prices plunging. In fact, there’s a new iron ore mine coming online in Australia this year. At full capacity it will produce 55 million metric tons of ore a year. At the same time, Vale is bringing a new iron project online in Brazil.

This all sounds bearish, and it is, short-term. Now for some good news.

China’s Not Dead!

Despite all the handwringing, Chinese demand for base metals is still growing. Sure, demand is growing more slowly. But China’s copper demand is still going to be 4% to 4.5% higher this year than last. And it should grow another 3% or more next year.

What’s more, that estimate may be low. The country’s latest five-year plan sets out ambitious expansion targets. China’s President Xi Jinping said he expects China’s economy to grow around 7% this year.

That’s MUCH higher than Wall Street’s target. But let me say that there are $3.51 trillion reasons why President Xi can be right. That’s the size of China’s foreign exchange reserves. And if China has to spend its way to a recovery, it will.

Also, China just lifted its one-child policy. It’s too early to tell, but I bet there are a lot of little brothers and sisters on the way in China. As the father of two children, I can tell you that kids need an enormous amount of STUFF. And that could boost China’s GDP – as well as its consumption of aluminum, rubber, and other commodities – more than anything.

Miners Are Slashing Costs

There’s many ways to be profitable. One is to see demand go up, and with it, prices. Another is to cut costs. And that’s what many miners are doing. For one thing, energy costs are falling, as oil prices crater.

Also, miners are increasingly turning to automation in mines. Iron miners Rio Tinto (NYSE: RIO) and Fortescue Metals (ASX: FMG) are deep into automating trucks and mining machines. BHP Billiton (NYSE: BHP) is testing automated trucks as well.

By the way, this is good news for Caterpillar (NYSE: CAT) and other makers of automated equipment.

New Sources of Demand

3D printing is all the rage. So what goes into 3D printing powder? Titanium dioxide, steel, cobalt and other raw materials. All these have to be mined, of course.

Titanium dioxide in particular comes from sludgy “mineral sands.” Who mines that? Rio Tinto for one. And the company sees demand soaring.

Rio Tinto is “positioning ourselves on a technical side and a production side” for a potential spurt in demand for 3-D printing powder, the company’s diamonds and minerals chief executive Alan Davies said in press reports.

I’m not saying that 3D printing demand will replace conventional demand for mine production. I’m saying that with new technologies advancing at the speed of light, there are things being invented right now that will still require mined materials. Not everything can be a collection of electrons on the Internet. The world still needs real stuff.

Get Ready to Shift Higher

After all, the International Monetary Fund still expects global GDP to grow 3.1% this year and 3.6% next year. And hidden within those headline numbers are about 300 million people in Asia just itching to join the middle class.

That means they’ll want air conditioners and modern kitchens. They’ll want phones. They’ll want cars.

And here’s the funny thing – despite all the gloom and doom over China, China’s car sales rose 13% in October from a year earlier. Does that sound like a collapse to you? Heck no. In fact, it sounds like a rebound.

So, we’ll see demand for commodities rise again. China’s gold demand is already roaring ahead. Its demand for copper and iron will get back on track, too.

So, sure, mining has been a money pit lately. But that won’t last. Demand will come back strong. And the better mining stocks are on the launch pad.