January was not a good months for the broad markets. But Gold just experienced its biggest monthly jump in three years. What comes next?

Here are some weekly charts of silver and gold that I'll be watching. First, gold ...

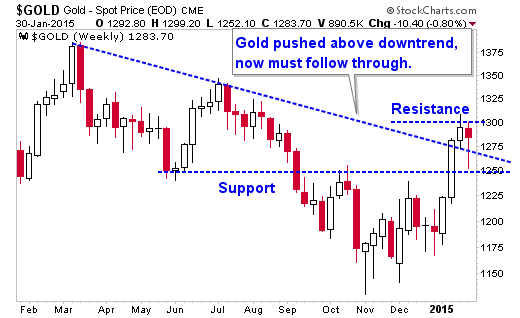

(Updated chart)

You can see overhead resistance at $1,300 and support at $1,250. Gold pushed above a downtrend. I think things look bullish. A lot depends on the U.S. dollar,which may have peaked the week before last.

Now, let's look at a weekly chart of silver.

(Updated chart)

You can see a similar pattern in silver (no big surprise there. Silver has overhead resistance at $19, and support at $15.

Some precious metals news worth reading ...

Chinese Banks in Talks to Take Part in Gold Fixing Replacement

There’s a “more diverse pool” of participants, including from China, interested in being part of the LBMA Gold Price, Ruth Crowell, chief executive of the London Bullion Market Association, said in a statement Monday.

Will Gold Equities Outperform Gold Bullion This Year?

Frank Holmes offers his latest analysis. One tidbit:

As of Thursday, assets in exchange-traded gold products rose for a tenth session, reaching the highest level since October. Investors added 65.6 metric tonnes so far this month, the most since September 2012. Gold equities, as measured by the NYSE Arca Gold Miners Index, are up 20 percent for January while the S&P 500 Index finished down 3 percent.

Is Gold The New High Yield?

With a rally to start the year, Gold is now up over 6% since the start of 2014 in dollar terms but up 19% in Yen terms and 30% in Euro terms.

The knock on Gold has often been that it “doesn’t yield anything” and that it can be highly volatile. These are valid critiques but today you can say the same thing about the Euro, the Yen, and the Swiss Franc. As long as this is true, the question for investors is which asset is a better safeguard of their wealth: Gold or negative yielding bonds in a rapidly depreciating currency.

Gold in fact has almost wiped out the 2013 collapse, in euros.

ReplyDeleteAnd most government bonds now have a negative real yield, so now their carrying costs are lower than for gold.