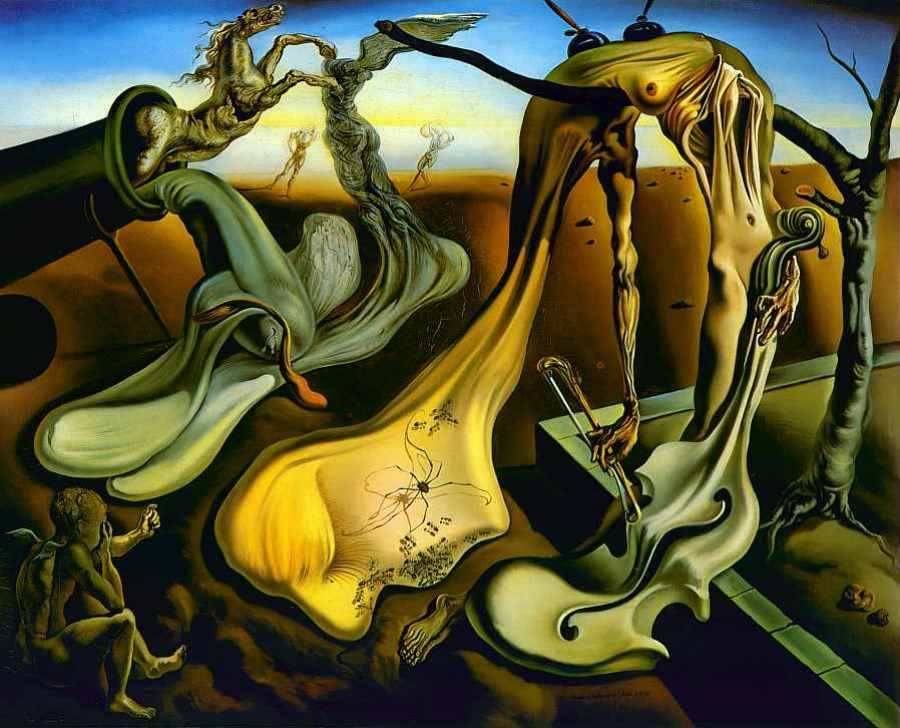

It originally had a much different opening, one based on my visit to the Salvador Dali Museum here in St. Petersburg, Florida. Here is the original opening ...

In 1943, Reynolds and

Eleanor Morse traveled from their home in Ohio to New York City, where they met

the artist Salvador Dali. Dali had moved to New York in 1940 to escape the war

in Europe. The Midwestern couple struck up a friendship with the artist.

So, as an anniversary gift for themselves. The Morses bought Dali’s painting "Daddy Longlegs of the Evening... Hope!"

The painting is rather disturbing – it is an antiwar piece painted

by Dali the refugee. It was also an expensive gift – the kind a couple has to

think about before buying. It cost the Morses $1,250.

That’s pretty cheap for a Dali, eh? But it was 1943. The average wage in that time was

$2,000 a year. A new car cost an

average $900. Indeed, for a young couple, it was an exorbitant gift,

even to themselves.

Fast-forward, and a lesser Dali painting from roughly the same period sold for more than $9 million a few years back. Daddy Longlegs is a famous painting -- it would probably sell for much more.

Dali’s paintings often contained multiple images, those on

the surface and those hidden. There is a hidden story to the purchase of that

painting. The hidden story is the way the dollar has been flattened since 1943.

Let’s say the Reynolds hadn’t bought that painting. Let’s say they wrapped up the money they

would have used to buy it -- $1,250 – and unwrapped it in 2015.

Would that have been smart? Was holding the U.S. dollar a good

investment over that time?

No. Make that, “Heck No!”

This is why we look for non-dollar investments.

I’m not going to try to convince you to invest in Dali

paintings. Though the Morses did just

that, adding more and more over the years. Now, you can see their collection at

the Dali Museum in St. Petersburg, Florida.

No, rather than Dali paintings, I want you to think outside

the box. There are many non-dollar investments.

Art, sure. But also, farmland, gold, and what are called “rare tangible

investments.”

We’ll talk about one of those rare tangible investments

today: Rare stamps.

You can see my interview with Geoff Anandappa, who I mention in the article, here: https://www.youtube.com/watch?v=gb08DcJA-Dw

No comments:

Post a Comment