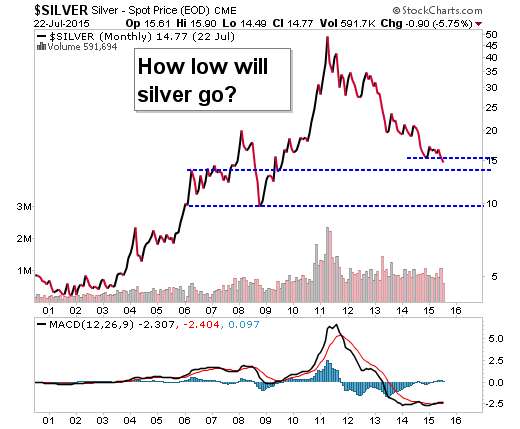

Here's an update of a chart of silver I posted a couple weeks ago. You can see see that while silver is testing support right now, it isn't definitely breaking it. This, despite the recent carnage in gold.

(Updated chart)

If I had to bet, I'd say silver is waiting to see if gold breaks below that "must-hold" support at $1,080.

If gold can hold that support and rally, then silver should be in for a face-ripper to the upside.

(Updated chart)

If I had to bet, I'd say silver is waiting to see if gold breaks below that "must-hold" support at $1,080.

If gold can hold that support and rally, then silver should be in for a face-ripper to the upside.

The latest silver news ...

By all estimates, there should be at least 100 billion billion near-Earth-like planets in the universe. So where are all the aliens?

This article delves into the mystery of the Fermi paradox. http://qz.com/452452/where-are-all-the-aliens/

You can see how the US dollar has a very bullish chart right now.

(Updated chart)

As the dollar powers higher, it weighs on oil and gold.

I turned in a 32-page report on China on Monday. We'll see when it gets out to subscribers. Here's a chart ...

(Updated chart)

People who think this recent sell-off in China's stocks is unprecedented have amnesia. China has a recent history of wild swings up and down.

(Updated chart)

People who think this recent sell-off in China's stocks is unprecedented have amnesia. China has a recent history of wild swings up and down.

The oil market is in chaos. I wouldn't try to read too much into a chart right now. That said, here's a rare "pouncing dragon" chart forming in $BRENT.

(Updated chart)

You can see the dragon coiling up, ready to pounce, its tongue lolling out and indicating the next leg down.

And now I must admit I am only fooling. There is no such thing as a “pouncing dragon” pattern, in oil or anything else. This is just a reminder to not read too much into an extremely tricky market.

In truth, there is a lot going on in the crude markets.

(Updated chart)

You can see the dragon coiling up, ready to pounce, its tongue lolling out and indicating the next leg down.

And now I must admit I am only fooling. There is no such thing as a “pouncing dragon” pattern, in oil or anything else. This is just a reminder to not read too much into an extremely tricky market.

In truth, there is a lot going on in the crude markets.

- OPEC production is rising

- Iran’s potential surge, with its "superweapon" of 30 to 40 million barrels of oil floating in storage in tankers, read to go to market

- U.S. production plateauing and maybe rising higher

- Russia’s eagerness for exports, helped by a weak ruble.

It all sounds bearish. But don't be surprised if we get a rip to the upside. The best thing to do in oil is either A) sit tight in positions that pay you to own them or B) play CONTRARY to short-term moves. Like short the next rally, maybe.

Or do what you want. I'm not the boss of you. Good luck and good trades.

I'm not enouraged by recent price action in silver.

(Updated chart)

On March 11, silver closed (down) at $15.46, and it had a low for the day at $15.26. If those are violated, silver could go lower still. If that happens, we'll look for support around $13 and potentially support under $10 to come into play.

But what could drive silver that much lower? Greece? It's a tempest in a tzatziki bowl. A collapse of the Chinese stock market, maybe, as traders and investors sell what they can because the value of their shares have gone up in smoke?

Certainly global supply and demand support HIGHER prices for silver. And I put MACD on the bottom of the chart. It seems to be positively diverging from recent price action. Again, that would point to higher prices.

Still, we need to know worst-case scenarios. So now you know.

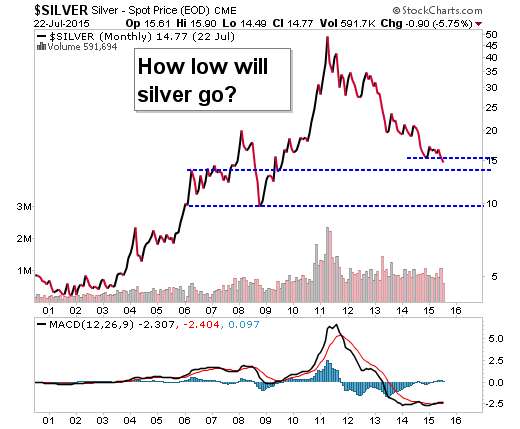

(Updated chart)

On March 11, silver closed (down) at $15.46, and it had a low for the day at $15.26. If those are violated, silver could go lower still. If that happens, we'll look for support around $13 and potentially support under $10 to come into play.

But what could drive silver that much lower? Greece? It's a tempest in a tzatziki bowl. A collapse of the Chinese stock market, maybe, as traders and investors sell what they can because the value of their shares have gone up in smoke?

Certainly global supply and demand support HIGHER prices for silver. And I put MACD on the bottom of the chart. It seems to be positively diverging from recent price action. Again, that would point to higher prices.

Still, we need to know worst-case scenarios. So now you know.