Today, I recommended Gold & Resource Trader subscribers grab small gains on a double-inverse oil ETF. We'll see if it's the right or wrong thing to do. In other news ...

India's June Gold Import Highest in 12 Months

Despite the fact the new Indian government, led by Narandra Modi since May, hasn't lowered the import duties on both gold and silver, Indians keep on buying precious metals. Despite the fact we already knew this, there was less gold being smuggled into the country and more imported through official channels last June; 77 tonnes were gross imported, which is up 48 % from a month earlier, and up 75 % from June last year. This was accompanied by falling premiums.

Retail Sales Rise Broadly

U.S. retail sales rose broadly in August and consumer sentiment hit a 14-month high in September, which should ease concerns about consumer spending and support expectations for sturdy growth in the third quarter.

Solar Storms Sending Biggest Threats to Earth Today and Tomorrow

The U.S. Space Weather Prediction Center is tracking two coronal mass ejections, “huge expulsions of magnetic field and plasma”. Earth should be spared the most crippling impacts of these kinds of events, which can include disruptions to electric grids and radiation strong enough to cause polar flights to change routes.

With oil under $100, China trader books world's largest ship to store crude

A Chinese trading firm has booked the world's largest super-tanker to store crude at sea, adding to a growing flotilla of vessels used for floating storage as benchmark oil prices slip below $100 a barrel.

Blowback: Sanctions against Russia threaten Exxon deal with Russia's Rosneft to drill in Arctic.

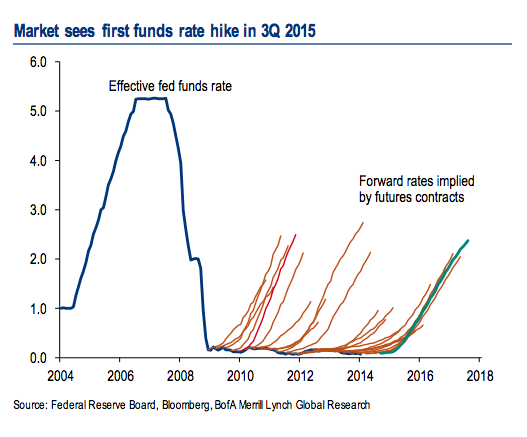

When Will the Fed Raise Rates?

The market now expects the Fed to start raising rates in Q3 of next year.

Photo of the Day

There is a silver mine in Mexico that grows giant crystals, as big as 50 feet long and 4 feet wide.

The crystals are formed by hydrothermal fluids rising from the magma chambers below.

Have a good weekend.

An Open Letter to the Mining Industry

ReplyDeleteBelow is a letter I plan to send to each producing mining company and precious metals mutual fund that I own personally. Gold and silver prices have been diluted by paper contracts to the point where no money can be made producing gold and an industry loss producing silver. Years ago, Rob McEwen of Goldcorp decided to withhold the sale of gold production to be held in their treasury until prices were higher. THIS is exactly what needs to be done now as a counterbalance to the unbacked paper contracts being sold to depress prices. The COMEX and naked shorts need to be starved for metal, the strong demand is doing this slowly while the mining industry could do this very quickly.

Please, copy and paste the below and sign with your name to any producing mining companies you have investments in. Also, do the same for any gold mutual funds you may own and ask the money manager to contact their holdings with this same letter. Government has an incentive to keep metals prices down and the lapdog regulators are allowing it to happen. Price manipulation is illegal, if the authorities will not fix it, hopefully the industry itself has sense enough to finally do something!

http://blog.milesfranklin.com/an-open-letter-to-the-mining-industry