Anyway, we've soft-launched my new publication, $10 Trigger Alert. It seems to be going well. The stocks are going up. What nice change from natural resources.

That doesn't mean gold, silver, oil & gas, and other natural resources still don't interest me. Of course they do. Here are some things I find interesting ...

#1: Gold miners' reserves pricing assumes big rally ahead

#1: Gold miners' reserves pricing assumes big rally ahead

From the story:

According to a survey by consulting firm PwC for its new Gold, Silver and Copper Price Report 2015, 60% of gold mining companies expect the price of gold to head lower in the next 12 months. That compares to 7% last year.

According to a survey by consulting firm PwC for its new Gold, Silver and Copper Price Report 2015, 60% of gold mining companies expect the price of gold to head lower in the next 12 months. That compares to 7% last year.

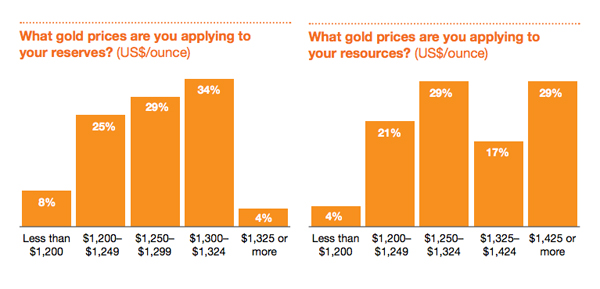

Despite this pessimism however, gold miner's longer term assumptions assume a strong recovery in the gold price from today's levels.

When asked what gold price companies are using to determine reserves, the average among respondents was $1,241 per ounce, with a range of between $950 and $1,350. For resources, the average was $1,331 per ounce with a range of between $950 and $1,600.

Note: I have a an interview HERE where I talk about the future haircuts miners are going to have to take, among other things, if the price of gold doesn't go higher soon.

#2: India Back to Being World's Top Gold Consumer

India reclaimed its world’s top gold consumer crown from China as demand for jewelry surged almost 60% in the third quarter of the year, fresh data from the World Gold Council (WGC) shows.

Global demand, however, fell to its lowest in nearly five years as Chinese buying slid by a third and gold jewellery, the biggest single area of consumption, dropped 4% to 534 tonnes.

Overall, India —which had lost his position as the world’s No.1 gold consumer to China in 2011—bought 39% more gold in the run-up to Diwali and the start of the traditional wedding season.

Gold smuggling into India has skyrocketed since the government ratcheted up restrictions and taxes on legitimate imports of the precious metal. According to the council, about 200 tons of gold came through unofficial route last year and a similar quantity is also expected this year.

Note: See how they buried the bad news in the second paragraph? World gold demand has dropped to its lowest level in 5 years. Fu-u-u-u-u-u-u ....

#3. Gold Chart Sure Looks Like It's Going Lower

I made this chart of the GLD, which tracks the percentage movements in gold pretty closely, on Stockcharts this morning. No one has a crystal ball. But it sure looks like gold is consolidating after a breakdown. Such consolidation usually resolves in the direction of the previous move.

How much lower? If you liked gold at, say, $1,000, you're probably going to get a chance to love it again.

I would love to be wrong on this, by the way. By all means, feel free to show me up so bad I make Dennis Gartman look good.

That said, there are plenty other places to make money. I'll give you one example. The fact that oil is folding like an old tent means a lot of opportunities to make money. That's what we're doing in $10 Trigger Alert. And we've also positioned for it in Oxford Resource Explorer. And those picks are doing quite splendidly.

Also remember that nothing goes down forever. Have money ready when the bottom comes.

By using BullionVault you are able to buy physical gold & silver by the gram at current market exchange rates.

ReplyDeleteCreate your free account today and get 4 g's in free silver as a welcome bonus.