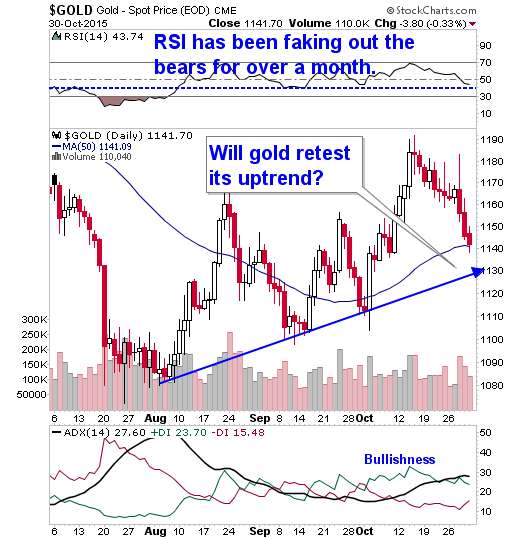

(Updated chart)

You can see that gold ended Friday right at its 50-day moving average. Maybe it will bounce here. However, I think it more likely that gold will go down and test that uptrend that started in August-September. If you're bullish on gold, that would be a buying opportunity.

This move lower should be accompanied by wailing and gnashing of teeth. RSI will give a sell signal, and many technicians will act on it. But it's fair to say that RSI is not useful now, and has been faking out bulls and bears for some time. We've seen this momentum indicator dip to give sell signals only to find support further down. The same this time around would not be surprising.

Most interesting is that the U.S. dollar faded along with gold on Thursday and Friday. I'm not sure what that means, but it bears watching.

Gold sold off (and the dollar rallied) when the Fed hinted that it might hike interest rates in December. That's a lie not worthy of a Florida used car salesman, but this jittery market bought it anyway. It seems like currency traders are figuring things out. Maybe gold traders are next.

The potential debt ceiling fight was resolved with astonishing quickness, and that also supported the dollar and hurt gold. At least I think so. Maybe the fear trade will fade. That's what the bears are probably hanging their furry hats on. But remember this is seasonally a strong time for gold (the love trade, as Frank Holmes calls it).

Hat-tip: GoldCore blog

Good luck and good trades. And to all the folks who attended the New Orleans Investment Conference and took time to talk to me about gold, oil and other things, it was great seeing you. There were some sharp minds in that crowd. Thanks for coming.

No comments:

Post a Comment