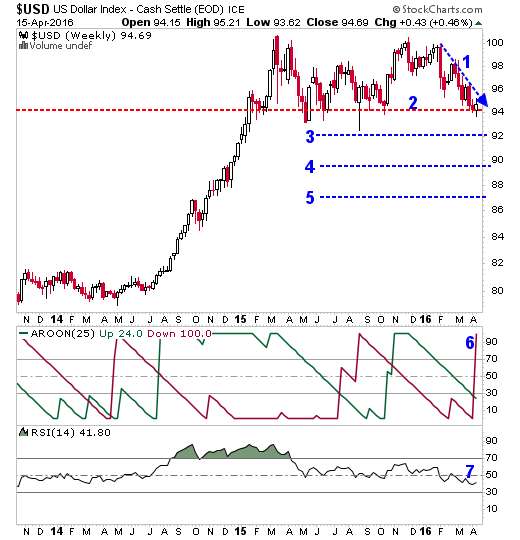

A weekly chart of the US Dollar Index shows it is in real trouble. Get a gander of the chart, then I'll explain.

(Updated chart)

1. The recent decline in the U.S. dollar. Any fool can see that. But that decline brings the green back to ...

2. Important support. The dollar index is at multi-month lows. This must hold. If it doesn't ...

3. First Fibonacci support.

4. Second Fibonacci support.

5. Third Fibonacci support.

6. Weekly Aroon trend indicator just gave a powerful sell signal. Most of you are unfamiliar with Aroon, though, so ...

7. Momentum, as measured by weekly RSI, is definitely weakening.

If you want fundamentals that might prompt a move below support, here are some things I am watching.

Saudi Arabia threatens to sell off U.S. assets if Congress passes a bill that would allow the Saudi government to be held responsible for any role in the September 11 attacks. (link)

That's up to $750 billion in U.S. assets. Including lots of Treasuries. Foreign ownership of U.S. Treasuries is one of the things supporting the U.S. dollar.

And the Saudis have reason to be worried. 60 Minutes just did a segment on Saudi involvement in 9/11.

Estimates of U.S. GDP Growth Are in The Tank. The Atlanta Fed GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2016 is 0.3% on April 13. ZERO POINT THREE PERCENT!

Sure, first-quarter GDP was weak last year, too. But 0.3%. Great googly-moogly! That is awful.

Maybe things will pick up in the second quarter. Sure. As the oil patch collapses in on itself, keep telling yourself that.

The point is, with economic growth this weak, I don't see how the Fed can raise interest rates. The Fed recently cut its number of intended hikes this year from four to two. How does NONE sound to you? Sounds about right to me. And maybe the market is getting a whiff of that, too.

Economic Indicators are Weakening. Monthly data for March featured a big decrease in industrial production and capacity utilization. Retail sales also fell, with a slump in vehicle sales getting most of the blame. Producer prices decreased.

I'm not saying we're going into recession. I'm saying this is more evidence the Fed can't raise rates. That cuts more support out from underneath the dollar.

So what does this have to do with gold? Easy. Gold is priced in dollars. Usually, when the dollar moves in one direction, gold moves in another. It's what I call the "seesaw of pain."

For 4 1/2-years, gold was on the painful end of that see-saw. Now, that see-saw may be about to come slamming down on the dollar's head.

No comments:

Post a Comment