The U.S. dollar enjoyed a nice rally last week. But unless it can break out this week, the rally is probably done.

(Updated chart)

I would keep the following points in mind ...

- Fed officials have warned that markets are "wrong" to expect just one rate hike for 2016.

- CPI data comes out on Tuesday, and inflation probably strengthened in the last measured period.

- FOMC minutes from the April meeting come out on Wednesday.This will be scrutinized for hawkish speak that indicates a June or July rate hike is imminent.

- Goldman Sachs says the oil bear market is "over" due to falling U.S. production and chaos in select OPEC members.

- Economic numbers out of China are downright lousy.

- Earnings for S&P 500 continue to deflate. This is due in part to a too-strong U.S. dollar.

- What's more, headline earnings cover carnage in GAAP earnings. For example, Adjusted net income at S&P 500 companies rose 6.6% to $840 billion last year. Under GAAP, income at those same companies actually declined 11% to $562 billion.

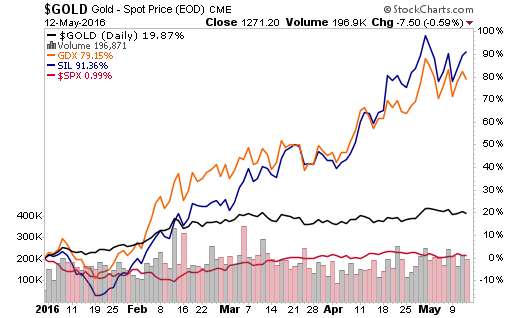

If the dollar does continue to rally, we might get the buying opportunity in gold that everyone has been waiting for. On the other hand, gold miners are one of the few things working in the market now, so there might not be as much of a dip as some anticipate.

Good luck to us all, and good trades.