Gold is down again this morning, as investors fear the Fed is going to taper its stimulus. Cue the gnashing of teeth.

I visited one project yesterday, and I'm leaving soon to visit another project, this time near scenic (?) Elko. And I'm going to another project tomorrow, and more projects through Friday. I think Nevada is the happening place for mining, especially now that Mexico is talking about raising taxes on miners.

Driving through Nevada, it's amazing how empty of people this state is. But there's still plenty of stuff here -- mineral stuff. It bubbled up millions of years ago, as the Pacific tectonic plate ground against the North American plate. Along with nearly ripping away California, it twisted, bent, and thrust the earth enough to push metallic deposits near the surface.

The grinding of those two plates along the fault lines dividing them also aggravated the "hot spots" of volcanic activity, which is why there are volcanic cones and caldera all over Nevada.

Do you know what volcanoes can bring bubbling up to the surface? Gold, silver, copper and other minerals.

These minerals were laid down millions of years ago. They were covered by more rock, and that rock has been eroded away over time. That's why early explorers found rich outcroppings of all sorts of metals.

Now we're on to the next round -- rich deposits that weren't visible on the surface. They're still there, though. Lots of them.

Driving through Nevada, you can see these huge upthrusts of rock lying all over the countryside, like sleeping giants. And it makes me realize how our ancestors could believe there were giants in the Earth.

And some of those giants are guarding some of the richest treasure troves imaginable.

For me, it's amazing how passionate people get about gold, both for and against. As I pointed out recently, there are plenty of other things you can invest in right now (solar ... oil services stocks ... Budweiser, etc).

In fact, I think the broad stock market still looks like it can go higher.

But I keep coming back to gold. For a couple reasons: It's insurance against a corrupt financial system, the laws of supply and demand still apply, and many miners look dirt-cheap. What's more, if current short-term trends hold, they may get cheaper. That's fine by me. I'l buy 'em cheap as long as the long-term trends hold.

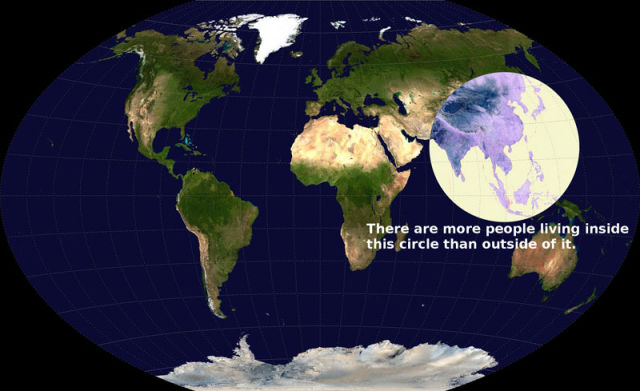

Hey, let me share a chart with you. It's a chart (sort of) of global population density.

source

More people live INSIDE that circle than OUTSIDE of it. You know what they generally have in common? A cultural affinity for gold. And now millions and millions of them are joining the middle class. Since a trend like that exists, I want to be on the right side of it.

The giants in the Earth are stirring my friend. They're slow to waken, but when they do, be on their good side. Good luck and good trades.

No comments:

Post a Comment