OPEC said demand for its crude oil will be lower than expected next year, with a surge in U.S. output potentially bringing its production to levels not seen since the past decade.

In its monthly oil-market report, the Organization of the Petroleum Exporting Countries said it had lowered the estimate of demand for its crude by 200,000 barrels a day for 2015 and by the same amount for this year. As a result, markets will need 300,000 barrels a day less of OPEC crude next year, it said.

The new OPEC demand forecast would bring its expected production next year to 29.2 million barrels a day, a level not see since the group was forced to slash its output in 2009 following a global financial crisis.

Despite lower demand for its crude, OPEC said its production rose by 231,000 barrels a day in August as Libyan oil ports and fields reopened.

READ

Commodities Fall to 8-Month Low as Brent Stays Below $100

The Bloomberg Commodity Index of 22 raw materials fell 0.3 percent by 3:24 p.m. in London after earlier declining 0.4 percent to 122.9665, the lowest since Jan. 10. The gauge declined 2.1 percent this year. Brent oil traded below $100 a barrel for a third day.

Commodities are heading for a fourth annual decline as rallying stock markets and a strengthening dollar curbed demand for an alternative investment. Oil prices are set to drop next year as U.S. crude output reaches a 45-year high, the Energy Information Administration said yesterday. The U.S. corn crop is a record high, the U.S. Department of Agriculture forecast.

READ

Cheapest US Gasoline Since 2010 Set to Get Cheaper

The average is $3.428 a gallon, down 6.2 percent since Memorial Day on May 26, AAA data show. That’s the largest decline from the start of the summer driving season since 2008. U.S. refineries operated at the highest-ever seasonal rates every week since July 4.

Processors are using domestic crude that costs less than foreign imports as horizontal drilling and hydraulic fracturing in shale formations increased output to the most since 1986. Gasoline will drop another 10 to 20 cents a gallon by the end of October as retailers switch to cheaper winter-blend fuel, said Michael Green, a Washington-based spokesman for AAA, the largest U.S. motoring group.

READ

Oil Prices That Major Producers Need to Survive

READ

Gold Advances as Drop to 3-Month Low Spurs More Buying

Assets in gold-backed exchange-traded products rose by 2.2 metric tons yesterday, snapping a six-session slide. Bullion earlier touched a three-month low. The price slump will help attract physical buyers, Abhishek Chinchalkar, an analyst at Mumbai-based AnandRathi Commodities Ltd., said in a report today.

READ

Goldcorp: We have hit PEAK gold

The CEO of the world's most valuable gold miner Goldcorp (TSE:G) says "peak gold" will be reached this year or in 2015.

Chuck Jeannes told the Wall Street Journal global gold production will start to decline "as easy-to-mine gold deposits become harder to find" and in the absence of any major technological breakthrough.

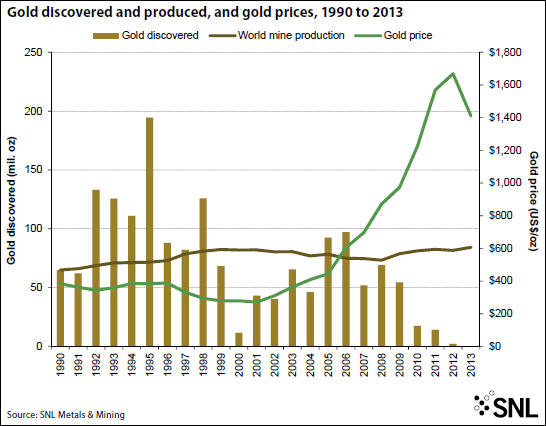

The amount of gold discovered and the number of major discoveries (defined as any deposit with a minimum of 2 million ounces of contained gold) have been trending downward over time, from 1.1 billion ounces in 124 deposits discovered during the 1990s to only 605 million ounces in 93 deposits discovered since 2000.

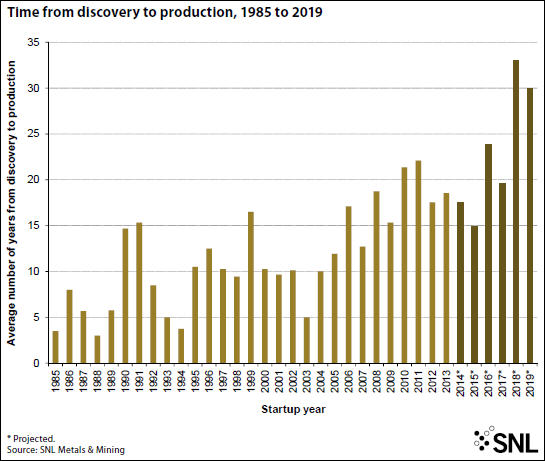

The time it takes to bring a deposit into production is also increasing significantly, slowing the rate at which production is replaced. Between 1985 and 1995, 27 mines with confirmed discovery dates began production an average of eight years from the time of discovery. The time from discovery to production increased to 11 years for 57 new mines between 1996 and 2005, and to 18 years for 111 new mines between 2006 and 2013.

READ

SEE ALSO

Investors, Speculators Leaving Gold Market In Droves

Precious metals investors poured money into the sector during July, but renewed selling in August only accelerated into September.

Global exchange traded funds backed by physical gold saw outflows last week of 13.4 tonnes, dropping total holdings to 1,713 tonnes, perilously close to four-year lows of 1,708 reached in June.

Some 17 tonnes left during August and that compares to inflows in July which was the best since November 2012. Year to date roughly 50 tonnes have left the dozens of funds traded around the globe and investment bank Barclays believes 100 tonnes could exit the market in 2014.

Gold ETFs saw outflows last week of 13.4 tonnes, dropping total holdings perilously close to four-year lows reached in June

Gold bullion holdings in global ETFs hit a record 2,632 tonnes or 93 million ounces in December 2012, but last year saw net redemptions of 800 tonnes.

READ

Yamana Temporarily Suspends Ramp-Up Activities At C1 Santa Luz

Yamana Gold will temporarily suspend ramp-up activities at its C1 Santa Luz mine, located in Brazil, and place it on care and maintenance. “The decision to temporarily suspend ramp-up activities at C1 Santa Luz and put it on care and maintenance is consistent with the company's focus on maximizing cash flow rather than production only and protects the significant inventory of mineral resources that that would otherwise likely be lost permanently to tailings with the current recovery levels,” Yamana says.

“In so doing, the potential future viability of the project is preserved as that inventory is profitably mined and recovered utilizing one of the metallurgical processes that will be implemented once the evaluation process is completed.”

The company says they will be evaluating the mine with an “alternative metallurgical recovery processes before end of 2015.

Yamana does not expect a large impact on its 2014 gold equivalent production guidance of 1.42 million ounces at all-in sustaining cash costs between $825 and $875.

READ

NON-MARKET NEWS

Scientists find mysterious species that defy all classifications of life

Science Explains Why Beer Is The Liquid That Fuels Civilization

The Start-to-Finish Guide to Securing Your Cloud Storage

Why China's Building a Military Base in the Middle of the Ocean

“Fists In the Mouth of the Beast”: On Irish Folklore

The 10 Most Underrated Jobs Of 2014

How's that gold seasonality working out?

ReplyDeleteNot well, I'm afraid.

ReplyDeleteThat's okay. They all laughed at me when I pointed out the correlation between summer gold performance and Indian rainfall.

DeleteNow they can witness the firepower of this fully armed and operational silver critical support line collapse!

I look forward to buying silver at cheaper levels, if you are correct. Though the precious metals market does like to make liars and fools out of us all.

ReplyDelete